Building Performance Standards (BPS) are redefining how building owners approach energy management, compliance, and long-term asset strategy. For years, benchmarking programs were centered around reporting energy data without requiring substantial improvements. BPS changes that model entirely. Now, states and cities expect buildings not only to track energy performance but to meet specific performance or emissions thresholds or risk facing significant penalties. With more than half of U.S. commercial space expected to fall under BPS rules by 2030, staying ahead is no longer optional—it is essential for financial stability, regulatory protection, and competitive advantage. Owners who act early will position themselves for smoother compliance, lower energy costs, and stronger long-term building value.

1. Understanding the Shift: Why BPS Matters More Than Ever

The transition from benchmarking to BPS represents a major evolution in building regulation. Benchmarking required owners to report annual energy use, making it primarily data-centric. In contrast, BPS enforces measurable improvements in energy use, emissions, or both. States such as New York, Washington, and Massachusetts are already enforcing their standards, while additional jurisdictions including Maryland, Colorado, and Washington, D.C., are preparing to implement theirs by 2026. This means that a growing percentage of building portfolios will fall under performance-based requirements that cannot be ignored.

This shift matters because it directly impacts financial planning and operations. BPS rules are designed to push buildings toward higher efficiency, reduced emissions, and improved sustainability. Instead of reacting to penalties or scrambling at the last minute, owners who understand the changes now can develop a phased, cost-effective plan. Compliance is no longer about paperwork; it is about preparing your assets for a future where energy efficiency is tied to property value, market competitiveness, and reputation.

2. Conducting a Portfolio-Wide Risk Assessment

A portfolio-wide risk assessment is one of the smartest steps an owner can take to stay ahead of BPS requirements. This assessment examines which jurisdictions apply to your buildings, what performance thresholds they require, and how your current energy data compares to those thresholds. By reviewing each building’s current standing, owners can identify which properties are at risk of non-compliance, which are close to meeting standards, and which require significant improvements to stay on track.

A well-executed assessment also clarifies timelines, highlighting when specific rules begin, when interim deadlines occur, and how much time owners realistically have to address potential gaps. This insight allows owners to prioritize buildings, plan upgrades in phases, and allocate capital more strategically. Instead of reacting to last-minute audit requests or unexpected performance gaps, owners gain a clear, proactive roadmap that aligns compliance with operational goals and budget cycles. This early clarity is what allows portfolios to stay ahead of the regulatory curve.

3. Strengthening Benchmarking as a Strategic Asset

Although benchmarking started as a reporting requirement, it has become one of the most powerful tools for improving building performance. When used effectively, benchmarking provides a clear view of how energy is consumed across a building or portfolio. Regular tracking helps identify inefficiencies, detect anomalies, and highlight opportunities to reduce waste long before major issues surface. These insights translate into lower utility costs, reduced system strain, and a more reliable operational environment.

Benchmarking also enhances financial performance. Buildings that consistently monitor their energy usage tend to reduce costs by 10–15% annually simply by identifying patterns and making targeted operational adjustments. Even small reductions in energy expenses translate directly into improved NOI, which strengthens asset value. In addition, a strong benchmarking history supports incentive applications, audit planning, and BPS readiness. In a regulatory landscape where performance history matters, benchmarking becomes a critical foundation for long-term compliance success.

4. Scheduling Energy Audits Early to Avoid the Deadline Rush

Energy audits are becoming increasingly urgent as cities enforce stricter schedules and penalties for non-compliance. Los Angeles maintains its December 1 audit deadline through its EBEWE program, and New York City continues to enforce audits under Local Law 87. Meanwhile, cities like San Francisco and San Jose are preparing their 2026 audit cycles, which will require deeper levels of performance review. As these jurisdictions advance their timelines, demand for qualified auditors spikes, especially in the first quarter of each year.

Owners who schedule audits early avoid the rush, secure better pricing, and guarantee access to experienced professionals. Beyond compliance, early audits give you more time to implement recommended improvements, many of which qualify for rebates or incentives. The sooner your audit is completed, the sooner you can identify inefficiencies, plan upgrades, and incorporate findings into your broader BPS strategy. Completing audits ahead of deadlines ensures that compliance is smooth and predictable rather than rushed and costly.

5. Prioritizing Upgrades With Fast, High-Value Paybacks

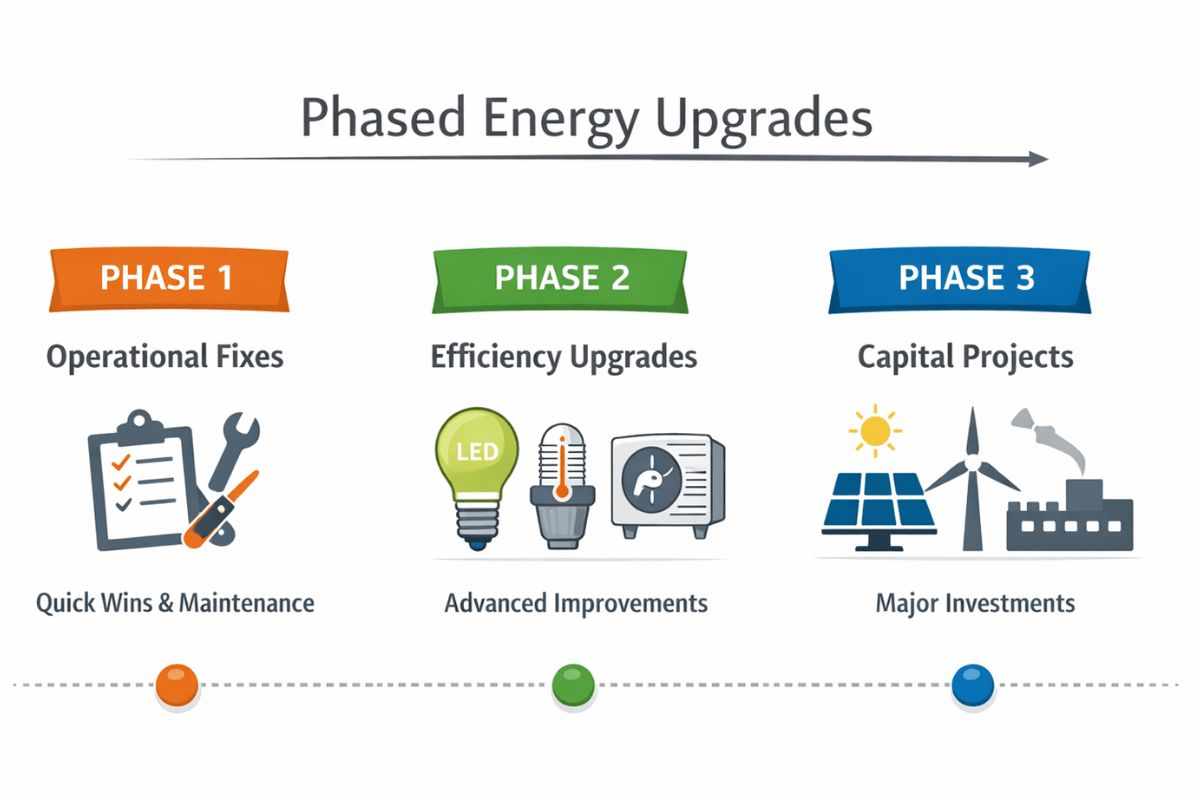

Once benchmarking and audits highlight areas of improvement, the next step is to prioritize upgrades that offer the greatest return. Many of the most effective improvements—like LED lighting, smart HVAC controls, or equipment tuning—provide measurable results in a short period of time. These upgrades reduce energy waste, improve occupant comfort, and lower utility expenses without requiring major capital investment. They also provide immediate traction toward BPS compliance, lowering a building’s performance gap long before deadlines approach.

More significant upgrades—such as HVAC replacements, heat pump installations, or advanced automation systems—require thoughtful planning, but they deliver long-term reductions in both energy usage and emissions. Because BPS rules often include future milestones or emissions targets, these medium-scale upgrades become essential components of long-term compliance strategies. Owners who phase improvements over several years can minimize financial impact, reduce operational disruption, and ensure that each upgrade aligns with both performance and regulatory goals.

6. Leveraging Incentives and Funding Before They Run Out

Incentives and rebates play a critical role in reducing the cost of energy improvements, but these programs often operate on limited annual budgets. As more jurisdictions adopt BPS requirements, the demand for incentives has grown rapidly, causing funds to be exhausted earlier each year. Owners who act early in their compliance planning are far more likely to secure funding for HVAC upgrades, lighting retrofits, automation systems, and other high-value improvements.

Many incentive programs require energy data, audit results, or documented performance histories. These documentation requirements align closely with benchmarking and audit records, meaning owners who maintain strong data systems are better positioned to secure funds. Early access to incentives can significantly reduce project costs and speed up payback timelines. For many buildings, incentives transform required compliance projects into financially attractive investments. Waiting too long, however, risks losing access to funding entirely.

7. Building a Multi-Year BPS Compliance Roadmap

Given that BPS rules often include phased timelines, interim targets, and long-term emissions goals, developing a multi-year improvement roadmap is one of the smartest strategies owners can implement. This roadmap outlines when each property needs to achieve certain thresholds and identifies the upgrades required to meet them. It also connects these milestones with equipment lifecycle planning, budget cycles, and operational schedules.

A multi-year roadmap reduces surprises and prevents owners from being forced into expensive, last-minute upgrades. Instead, improvements can be planned over several years, aligned with capital budgets, and scheduled during preferred operational windows. This structured approach ensures compliance while maintaining consistent financial performance. It also allows owners to strategically sequence improvements so that early upgrades unlock future benefits, such as easier emissions reductions or enhanced system performance.

8. Using Technology to Centralize and Simplify Compliance

Compliance becomes significantly more complex when managing multiple buildings across different jurisdictions. Each city may have unique reporting systems, deadlines, audit cycles, and performance thresholds. Using a centralized platform to track all requirements simplifies this complexity and allows owners to see deadlines, energy trends, and risk levels for each building in one place. This centralized visibility reduces administrative burden and helps owners make informed, timely decisions.

Technology platforms also support data consistency. Inaccurate or incomplete energy data is one of the most common causes of compliance issues, but automated data collection and standardized reporting minimize errors. Furthermore, centralized tools provide early warnings when buildings are trending off-track for BPS, allowing owners to intervene long before penalties become a concern. With regulatory frameworks tightening every year, technology offers a dependable way to stay ahead without drowning in paperwork or fragmented data.

9. Turning Compliance Into Long-Term Financial Growth

Although compliance is often seen as a cost, BPS requirements can become a source of financial advantage when approached strategically. Energy efficiency improvements lead to lower utility bills, which enhance NOI and increase asset value. Tenants increasingly prefer energy-efficient buildings because they offer lower operating expenses and align with corporate sustainability goals. Buildings that meet or exceed BPS standards often achieve higher occupancy rates, better retention, and enhanced market reputation.

In addition, proactive compliance helps reduce operational risks. More efficient equipment is less prone to breakdowns, requires less emergency maintenance, and operates more reliably. This reduces financial uncertainty and helps owners maintain predictable operating costs. In a real estate market where sustainability is becoming a differentiator, buildings that lead in performance will continue to gain long-term competitive advantage. Strategically aligning compliance with financial planning ensures that owners achieve both regulatory success and measurable ROI.

10. Partnering With Experts to Stay Ahead of 2026 and Beyond

With regulations expanding and deadlines approaching quickly, many owners benefit from partnering with experts who understand the intricacies of BPS, benchmarking, audits, and incentive programs. Specialists with national and local experience can translate complex regulatory language into actionable steps and help owners build tailored strategies that address the specific needs of each building. This guidance ensures that owners stay ahead of deadlines, avoid penalties, and capture all available financial opportunities.

A strong partner also provides continuity, ensuring that compliance activities remain consistent year after year—even if building staff or internal priorities change. VertPro®, for example, supports owners across dozens of U.S. cities with end-to-end management of benchmarking, audits, and BPS planning. By integrating compliance with strategic capital planning, expert partners help building owners transform regulatory obligations into long-term operational and financial advantages. With 2026 bringing new rules and deeper performance requirements, having the right partner can make compliance smooth, predictable, and profitable.

Final Thoughts

Staying ahead of BPS requirements is ultimately about preparation and strategy. Owners who begin planning now have the greatest flexibility to schedule audits, secure incentives, implement improvements, and align compliance with their financial goals. Early action minimizes risk, avoids high-cost emergencies, and positions buildings to perform strongly for years to come. With regulations growing more rigorous each year, smart strategies are the best way to protect your assets, improve efficiency, and build long-term value in a changing energy landscape.

Write a comment ...