If you manage property in NYC, this one regulation could change your entire strategy. The Benchmarking Law—formally known as Local Law 84—requires commercial buildings over 25,000 square feet to report annual energy and water usage. But what started as a reporting mandate has become a major driver of operational change under the city’s broader Climate Mobilization Act. A midtown office building recently saw its benchmarking score drop below a passing ENERGY STAR rating, prompting ownership to fast-track HVAC upgrades to stay compliant with Local Law 97’s carbon caps. In today’s NYC market, poor energy scores don’t just mean higher bills—they can influence tenant renewals, insurance premiums, and financing terms. With stricter energy efficiency regulations on the horizon, energy benchmarking is now the frontline of carbon footprint reduction.

Many property managers have treated benchmarking as a routine task—but those days are over. With fines under Local Law 97 reaching up to $268 per metric ton of CO₂ above your building’s limit, the financial stakes are growing fast. The good news? These regulations also open the door to long-term savings and incentives for proactive owners. A free consultation with our NYC energy benchmarking experts can help you pinpoint where your building stands, how to improve your score, and what steps to take to avoid costly penalties. In the next section, we’ll break down how these regulations are reshaping energy decisions, from retrofits to return on investment—so you can stay ahead, not scramble to catch up.

Great. Here's an expanded and more detailed version of the middle section of your blog post:

"How the Benchmarking Law is Reshaping NYC’s Energy Landscape"—now fully elaborated to increase the total word count and depth while maintaining clarity and structure.

From Reporting to Retrofitting: Benchmarking’s Expanding Role

The Benchmarking Law, or Local Law 84, was initially introduced as a reporting mandate. Its primary goal was to increase transparency around energy and water usage across New York City’s largest buildings. However, over time, benchmarking has evolved from an administrative requirement to a strategic driver of building performance upgrades.

When property managers submit their usage data to platforms like ENERGY STAR Portfolio Manager, that information becomes publicly accessible. This visibility has shifted the role of benchmarking. It’s no longer just about filling out forms on time—it’s about how your building stacks up in the city’s energy landscape. With tenants, investors, and regulators all paying attention to energy scores, benchmarking is becoming a reputational asset or liability.

For example, a building consistently scoring below a 75 ENERGY STAR rating is not just signaling energy inefficiency—it’s potentially forecasting upcoming fines under Local Law 97. In response, owners are no longer waiting for citations to act. They're investing in:

HVAC and lighting upgrades to cut baseline energy consumption.

High-efficiency boilers and chillers to reduce emissions.

Smart building controls that automatically optimize system performance.

The result is a growing trend: benchmarking is no longer just about reporting—it’s a catalyst for modernization.

Financial Stakes Are Rising—And So Are the Incentives

The financial impact of NYC’s energy laws cannot be overstated. Under Local Law 97, any building emitting more carbon than its allocated limit will face annual fines beginning in 2024. The rate—$268 per metric ton of CO₂ over the cap—could result in six- or even seven-figure penalties for older, inefficient properties.

This looming liability is pushing owners to reevaluate how they allocate capital. Suddenly, energy efficiency is not just a cost—it’s a hedge against future penalties. More importantly, the city and state have introduced financial tools and incentives to support these investments.

Available Incentives and Financing Options:

NYCEEC Clean Energy Loans: These offer affordable financing tailored to energy improvements that directly impact benchmarking performance.

Con Edison Incentives: Con Ed’s Commercial & Industrial Energy Efficiency Program provides rebates for installing high-efficiency equipment, controls, and building automation.

C-PACE (Commercial Property Assessed Clean Energy): This program lets property owners pay for major capital upgrades through assessments added to their property tax bill, with no upfront cash required.

Together, these incentives are helping turn compliance into a financially viable path forward. A building owner facing $250,000 in projected fines over the next five years may instead opt for a $500,000 retrofit—especially if that retrofit qualifies for $100,000 in rebates and PACE financing covers the rest.

How Energy Scores Affect Tenant Behavior and Property Value

As sustainability becomes a core priority for corporate tenants, energy performance is beginning to influence leasing decisions in ways not seen before. Tenants now ask about ENERGY STAR scores, greenhouse gas emissions, and overall sustainability ratings before renewing or signing new leases.

A building with a high energy score and clear decarbonization plan is positioned as a forward-thinking, low-risk asset. Conversely, an inefficient building—especially one at risk of Local Law 97 penalties—can quickly lose its edge in competitive leasing markets.

Key Impacts on Property Value and Leasing:

Tenant Retention: Environmentally conscious tenants are more likely to renew in buildings aligned with their ESG goals.

Rental Premiums: Energy-efficient buildings often command higher lease rates, particularly in sectors like finance, legal, and tech.

NOI Stability: Energy waste increases operating expenses, lowering Net Operating Income and affecting asset valuation.

Insurance and Lending: Some insurance companies and lenders now review energy benchmarking scores as part of risk assessments, potentially impacting coverage terms or interest rates.

For building owners, the message is clear: improving benchmarking performance is not just about avoiding fines—it’s about protecting long-term asset value and maintaining tenant demand in an increasingly green-conscious market.

Benchmarking Data as a Roadmap, Not a Report Card

One of the most underutilized aspects of energy benchmarking is its analytical potential. While many property teams focus solely on compliance, smart operators use benchmarking data to identify opportunities for improvement and inform capital planning.

Portfolio Manager, the EPA’s benchmarking platform, offers detailed analytics that can reveal:

Seasonal inefficiencies: For example, HVAC systems working harder in shoulder seasons than necessary.

Peak usage trends: Identifying high-demand days or months and correcting system overuse.

Low-performing meters or systems: Spotting outdated boilers or lighting zones that inflate consumption.

Turning Data into Action:

Establish a baseline: Benchmarking provides historical context, making it easier to measure the effectiveness of future upgrades.

Compare against peers: Understanding how your building compares to similar ones in NYC helps guide realistic performance targets.

Forecast Local Law 97 compliance: With energy and emissions data in hand, owners can run “what-if” scenarios to plan improvements ahead of deadlines.

By reviewing and acting on benchmarking data quarterly instead of annually, building teams can become proactive rather than reactive—saving time, money, and carbon.

The Strategic Edge of Early Action

Delaying action on energy performance can seem like a short-term cost saver—but that mindset often leads to rushed upgrades, missed rebates, and unnecessary penalties down the road. Owners who act early benefit from more than just peace of mind.

Benefits of Proactive Energy Management:

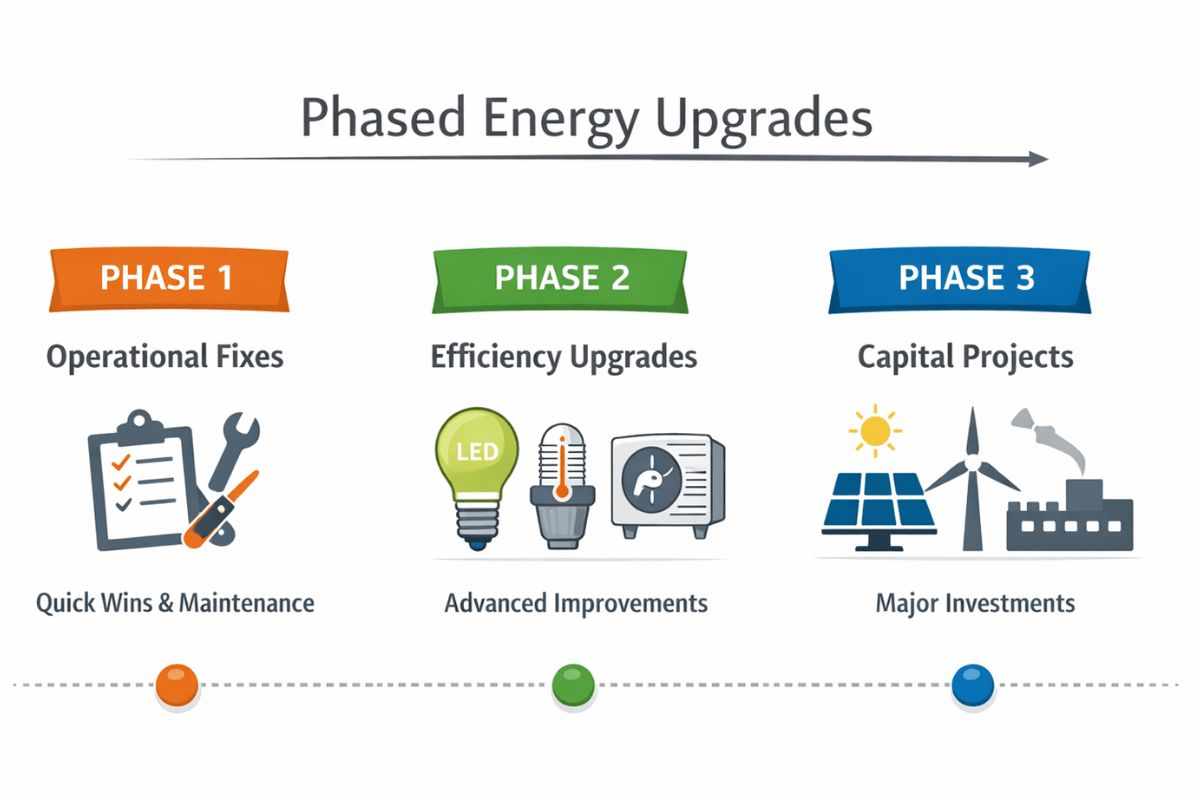

Optimized cash flow: Phased retrofits allow for more flexible budgeting, while still avoiding fines.

Enhanced property marketing: A proven track record of upgrades and emissions reductions is appealing to ESG-driven investors and tenants.

Vendor leverage: Early movers secure better rates from contractors, engineers, and equipment suppliers due to lower demand.

Most importantly, early upgrades allow owners to future-proof their assets. As carbon caps tighten every five years, those who’ve already invested will have far fewer adjustments to make than those who postpone improvements until absolutely necessary.

Closing the Loop: Turn Compliance into Competitive Advantage

The Benchmarking Law has transformed from a simple reporting requirement into a powerful force reshaping how buildings are managed across NYC. This post unpacked how Local Law 84 and related energy efficiency regulations now influence everything from capital planning and tenant retention to property value and compliance costs. We explored why poor energy scores lead to more than just fines, how data can drive smarter decisions, and why early action pays off in real dollars. Benchmarking isn’t a back-office chore anymore—it’s your building’s first line of defense in a tightening regulatory landscape.

If you manage a commercial property in NYC, the smartest move you can make is getting ahead of these changes. Our team of local energy benchmarking experts is here to help. Sign up for a free consultation to assess your current score, identify high-impact upgrades, and create a plan to cut emissions without cutting into your budget. Don’t wait for penalties to shape your strategy—let’s build one that protects your property and your bottom line.

VertPro.com offers tools and services to help property owners and managers improve building energy efficiency and meet regulatory standards. Whether you're looking for instant pricing on energy audits, need support with benchmark compliance, or want to explore available building upgrade options, VertPro® provides user-friendly technology solutions to simplify the process. Their platform helps ensure adherence to over 60 Energy Benchmarking and Efficiency Laws across the country.

Write a comment ...